Check for Errors

You can download the AL_W2Report_Check.xls (Updated January 27, 2015) to check your W2 file for errors before uploading to My Alabama Taxes. This Excel spreadsheet will check your file based on the specifications provided by Alabama Form 10 and the Social Security Administrations EFW2.

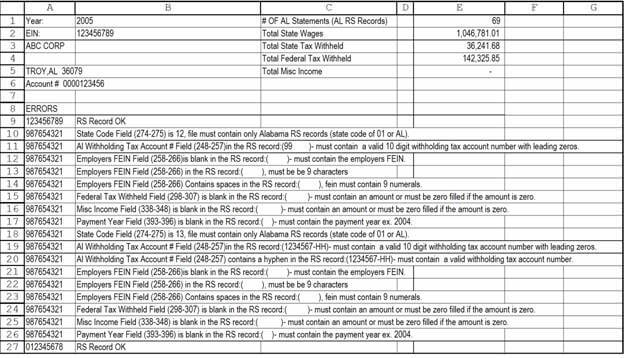

It will read each Alabama RS record (state code 01 or AL) and provide the following statistics:

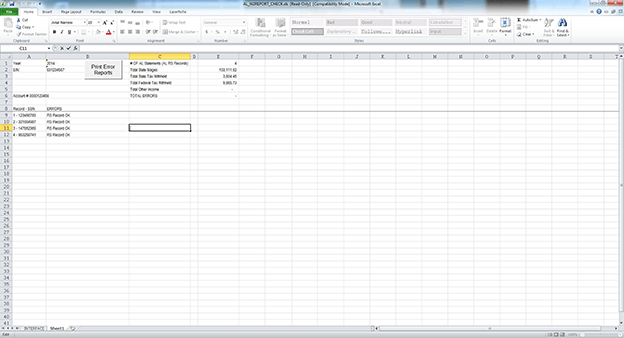

- # OF AL Statements (AL RS Records)

- Total State Wages

- Total State Tax Withheld

- Total Federal Tax Withheld

- Total Other Income

Verification

Errors will be listed on the spreadsheet by the SSN of the record containing the error.

- Record Length – each record must be 512 bytes (characters).

- Carriage Returns/Line Feeds – The file should not contain any carriage returns or line feeds. If it does, then you can download the AL_Export_Utility to remove the Carriage Returns/Line Feeds. If your file contains Alabama RS and other state RS records, this utility will export Alabama RS records to a new ALW2Report.txt file.

- Verifies that the SSN (columns 10-18) contains nine digits, is not blank, does not contain spaces, or does not contain dashes.

- Verifies that the first name (columns 19-33) contains only alpha and certain special characters (comma, period, apostrophe, hyphen, open parenthesis and close parenthesis).

- Verifies that the middle first name (columns 34-48) contains only alpha and certain special characters (comma, period, apostrophe, hyphen, open parenthesis and close parenthesis).

- Verifies that the last name (columns 49-68) contains only alpha and certain special characters (comma, period, apostrophe, hyphen, open parenthesis and close parenthesis).

- Verifies that the State Employer Account Number (Alabama Withholding Tax Account Number) (columns 248-257) is not blank, does not contain any spaces, does not contain all zeros, is 10 digits with the leading zeros or begins with R followed by nine digits.

- Verifies that the Federal Employer Identification Number (columns 258-266) is not blank, does not contain any dashes or spaces, is not all zeros and is nine digits.

- Verifies that the State code (columns 274-275) in the RS record is either AL or 01 (file contains only Alabama W2s). If the file contains RS records for other states you can download the AL_Export_Utility and use it to export only Alabama records to a new file.

- Verifies that State taxable wages (columns 276-286) is not blank/does not contain all spaces.

- Verifies that State income tax withheld (columns 287-297) is not blank/does not contain all spaces.

- Verifies that State Federal income tax withheld (columns 298-307) is not blank/does not contain all spaces.

- Verifies that State Miscellaneous income (1099) (columns 338-348) is not blank/does not contain all spaces.

- Verifies that Payment year (columns 393-396) is not blank/does not contain all spaces.

Instructions for using AL_W2Report_Check.xls to check your W2 file

- Download AL_W2Report_Check.xls (right click on link to save file).

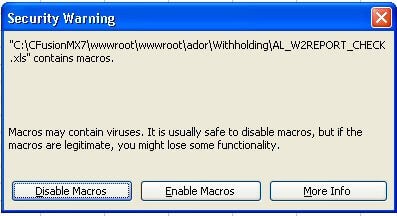

- Open AL_W2Report_Check.xls. A Security Warning will appear as shown below or on the spreadsheet.

- Select Enable Macros or Enable Content on the spreadsheet.

- Click on the Check File For Errors button.

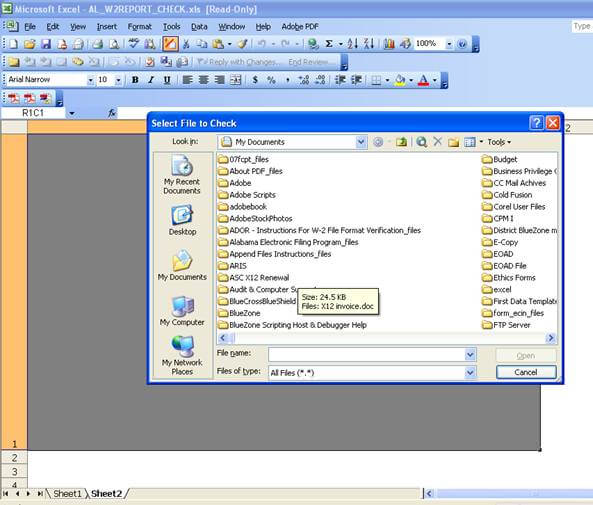

A menu box will appear. Select your file and click on the Open button. Note: You can only select one file.

If the file is acceptable, then you will receive a report with the totals from the file.

If the file contains errors, then you will be provided a list of errors. All errors must be corrected before uploading.

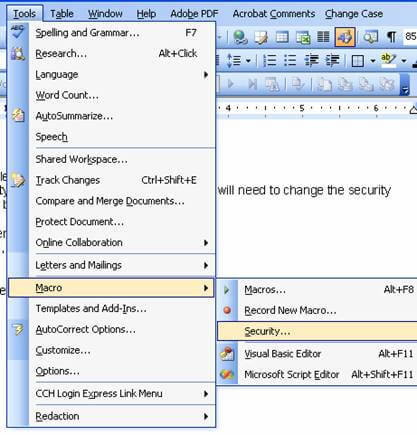

If you are using an older version of Excel and the Security Warning screen does not appear, you will need to change the security setting. To change the Security Settings in Excel, from the Menu select Tools, Macro, Security.

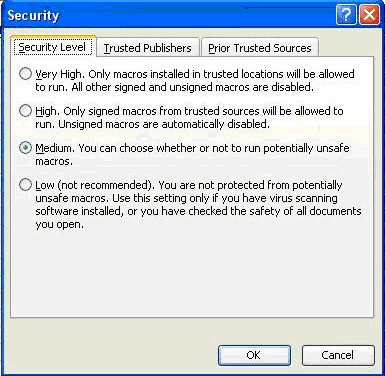

Select the Security Level tab, then select the Medium option and click OK.

After changing this setting reopen the AL_W2Report_Check.xls and follow the steps above.